A great product alone will not increase your sales today. Payment options must be reliable, secure, and less complicated. Whether running an online store or a retail shop, utilizing Credit Card Payment Services can significantly enhance your sales quickly.

Credit Cards for Businesses decrease the chances of losing potential customers and build brand loyalty. With the right strategies, a business can reap short—and long-term rewards. Below are some services that can quickly augment your sales technique.

Make Payments Easy as 1-2-3

Payment methods such as swiping, dipping, or tapping a card can be used in in-person retail environments. These contactless payments create a better shopping experience and can encourage impulse purchases. As a business, utilizing modern payment options reduces cart abandonment. When a complex checkout process is simplified, customer retention and loyalty increase significantly, leading to repeat purchases.

Reduce Your Payment Processing Fees

Businesses do not realize how much they could save with better-cost Credit Card Payment Services options. Most providers offer better rates, but businesses stick with overpriced providers by default.

Best providers even do free statement analysis to review your current payment processing fees and highlight areas with possible savings. You can save an immediate win, which helps grow your profit margins through lowered processing costs.

Integrate All Sales Channels

Your business is solely online, physically located, or a hybrid; consistent payment solution integration is critical. Modern businesses guarantee seamless integration between websites, point-of-sale terminals, mobile applications, and other sales channels.

This consistency improves streamlined operations, reduces human error, and helps manage all transactions from a single platform, thus building customer trust.

Payment Acceptance in eCommerce

If you manage an online shop, getting a Credit Card for Business explicitly designed for eCommerce will bring your business priceless benefits. These include lower fees for card-not-present payments, sophisticated fraud mitigation, and recurring billing or one-click checkout options. These developments help mitigate the high levels of cart abandonment most online retailers face, notably improving overall customer experience.

Enjoy a Free Statement Review to Maximize Savings

For businesses that have already implemented card payment terminals, having their current processing statements audited is certainly prudent. Almost all providers have free statement audits to make cost analysis and statement audits for cost reduction strategies. Even a marginal change in per-transaction fees can significantly increase savings for businesses that process high volumes.

Get Custom Solutions for Your Unique Business

Every business has a different approach to accepting payment. With a customized Credit Card Payment Service, you ensure your systems are synced with your operations for mobile payment acceptance for service businesses and invoicing for professional services, so customization allows rapid response to changing customer demands. In addition to flexibility, the ability to add subscription billing or enable a pop-up shop becomes effortless.

Improve Customer Trust While Increasing Security

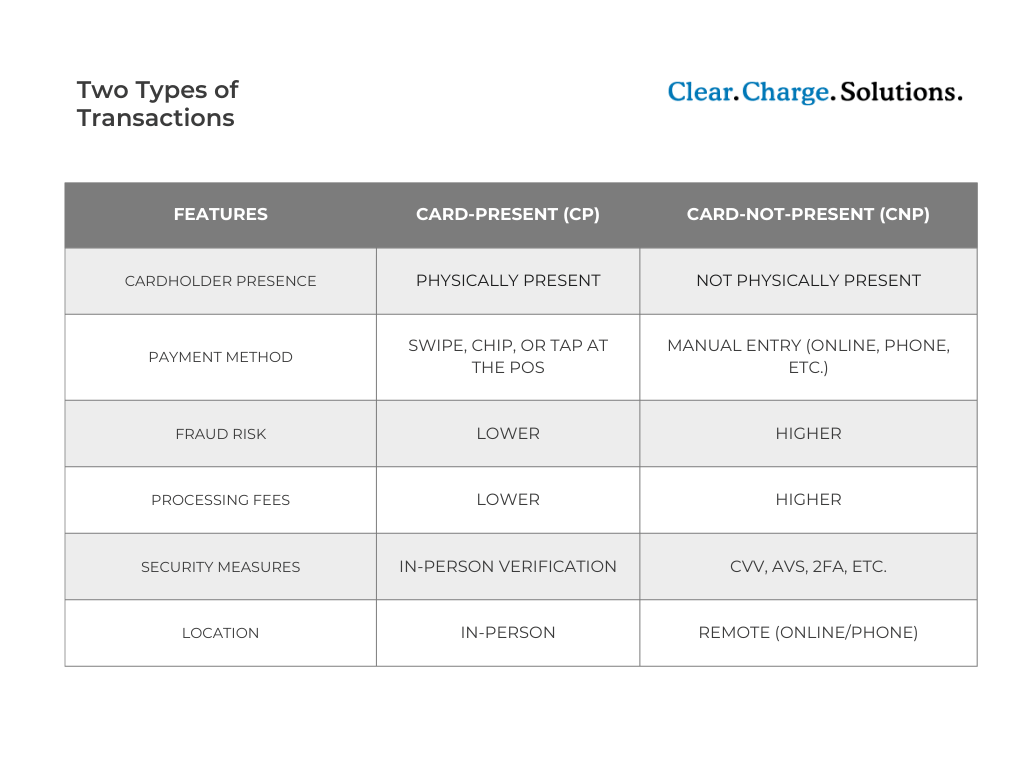

Customer security is one of the key considerations when dealing with delicate financial information. Fraud risk is usually low with card-present transactions since the cardholder’s identity can be physically verified at the moment of verification.

Adding security features such as CVV, address verification, and two-step authentication strengthens the defenses against chargebacks for card-not-present transactions.

Understanding the Two Types of Transactions

To make informed decisions, it’s essential to understand the differences between card-present (CP) and card-not-present (CNP) transactions. Here’s a quick overview:

FAQs About Credit Card Payment Services

Q: When can I begin to accept credit card payments?

A: With most providers, you can start accepting credit card payments in a few days, especially if you possess a merchant account.

Q: Can I continue normal operations when transitioning from one payment processor to another?

A: Yes. Thanks to professional integration support, the switch can seamlessly happen without disruption.

Q: How can I tell if I’m being charged too much for processing fees?

A: Payment service providers offer free statement analyses that reveal excessive and concealed fees.

Q: Are payment processing solutions that cater to specific business models available?

A: Yes. Solution providers craft customized setups for models like eCommerce, retail, and subscription billing.

Closing Comments

The right credit card payment services make a business soar to new heights. From improving payment collection efficiency to reducing overhead costs and supremely enhancing customer experience, the Credit Card for Business enables face-to-face transactions. At the same time, adaptable online sales are guarded with secure payment solutions.

Ready to elevate your customer experience with advanced payment solutions? Contact us today at (877) 847-4478 to discover how our credit card processing services can transform your business. Let’s make every transaction seamless! Check our IG for more information.